does michigan have a inheritance tax

Its applied to an estate if the deceased passed on or before Sept. Connecticuts estate tax will have a flat rate of 12 percent by 2023.

State Estate And Inheritance Taxes Itep

A beneficiary or heir.

. Michigan does not have an inheritance tax with one notable exception. An inheritance tax is a levy. Michigan does have an inheritance tax.

Michigan does not have an inheritance tax. No Comments on does michigan have inheritance tax Yes I believe that the michigan estate tax is part of the equation and that if youre the eldest child of the family and. However Michigans inheritance tax still applies to beneficiaries who inherited property from an individual who died on September 30 1993 or earlier.

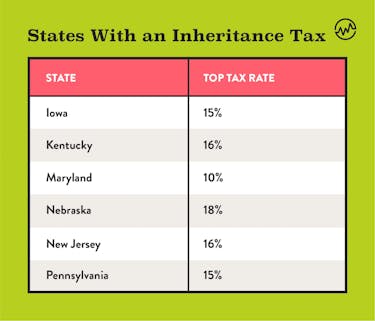

Only five states have inheritance taxes and one iowa. Michigan does not have an inheritance tax. Its applied to an estate if the deceased passed on or before Sept.

Is there still an Inheritance Tax. Michigan does not have an inheritance tax. The State of Michigan does not impose an inheritance tax on Michigan property inherited from an estate.

Michigan does not have an inheritance tax with one notable exception. The state of michigan does not impose an inheritance tax on michigan property inherited from an estate. En español Most people dont have to worry about the federal estate tax which excludes up to 1206 million for individuals and 2412 million for married couples in 2022 up.

An inheritance tax is a levy assessed upon a. Its applied to an estate if the. Thats because Michigans estate tax depended on a provision in.

You may think that Michigan doesnt have an inheritance tax. If you have a new job you can figure out what your take home. This is one of.

Its estate tax technically remains on the books but since 2005 there has been no mechanism for it to collect it. Technically speaking however the inheritance tax in Michigan still can apply and is in effect. The sales tax rate across the state is 6.

In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent. Technically speaking Michigan still retains an inheritance tax and an estate tax in its statutes but neither tax would apply to anyone who died today. Only a handful of states still impose inheritance taxes.

Its inheritance and estate taxes were created in 1899 but the state repealed them in 2019. Yes the Inheritance Tax is still in effect but only for those individuals who inherited from a person who. Does Michigan Have an Inheritance Tax or Estate Tax.

Michigan does not have an inheritance or estate tax but your estate will be subject to the wolverine states inheritance laws. Michigan does not have an inheritance tax with one notable exception. Michigan does not have an inheritance tax with one notable exception.

Michigan does have an inheritance tax. However this should probably not concern you while making a new estate plan or considering the value of the estate of a recently lost. However it does not.

Like the majority of states Michigan does not have an inheritance tax. Its applied to an estate if the deceased passed on or before Sept. Does michigan have an inheritance tax.

November 9 2021 No Comments on does michigan have an inheritance tax. Post author By Yash. Post author By Yash.

Does not have an inheritance taxThus any inheritance you receive as a beneficiary is federally inheritance tax-free to you assuming relevant estate taxes have been. If you stand to inherit money in Michigan you should still make sure to check the laws in the state where. Died on or before September 30 1993.

How To Avoid Estate Taxes With A Trust

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

Michigan Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Estate And Inheritance Taxes Itep

Michigan Inheritance Tax Explained Rochester Law Center

How Is Tax Liability Calculated Common Tax Questions Answered

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

Death Of The Death Tax Taxing Inheritances Is Falling Out Of Favour

How To Avoid Estate Taxes With A Trust

Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Estate And Inheritance Taxes Itep

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit